Digital Identity platform

Solution of the NIURON consortium to verify the customer's identity faster and more securely.

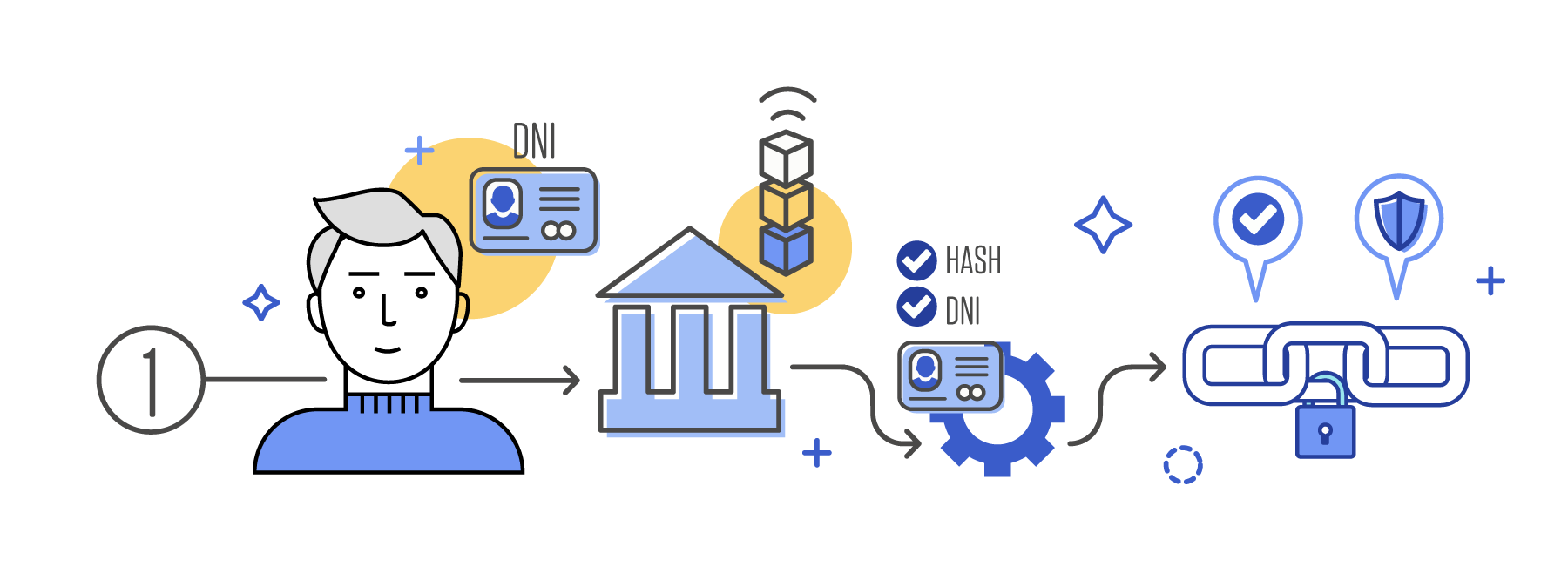

Currently, when registering a new customer with a financial institution, we are challenged by a complex identification process that requires us to gather various documents to prove the identity and the activity of the customer (ID card, salary, invoices, etc.). This process is repeated at all banks, duplicating efforts and generating inefficiency.

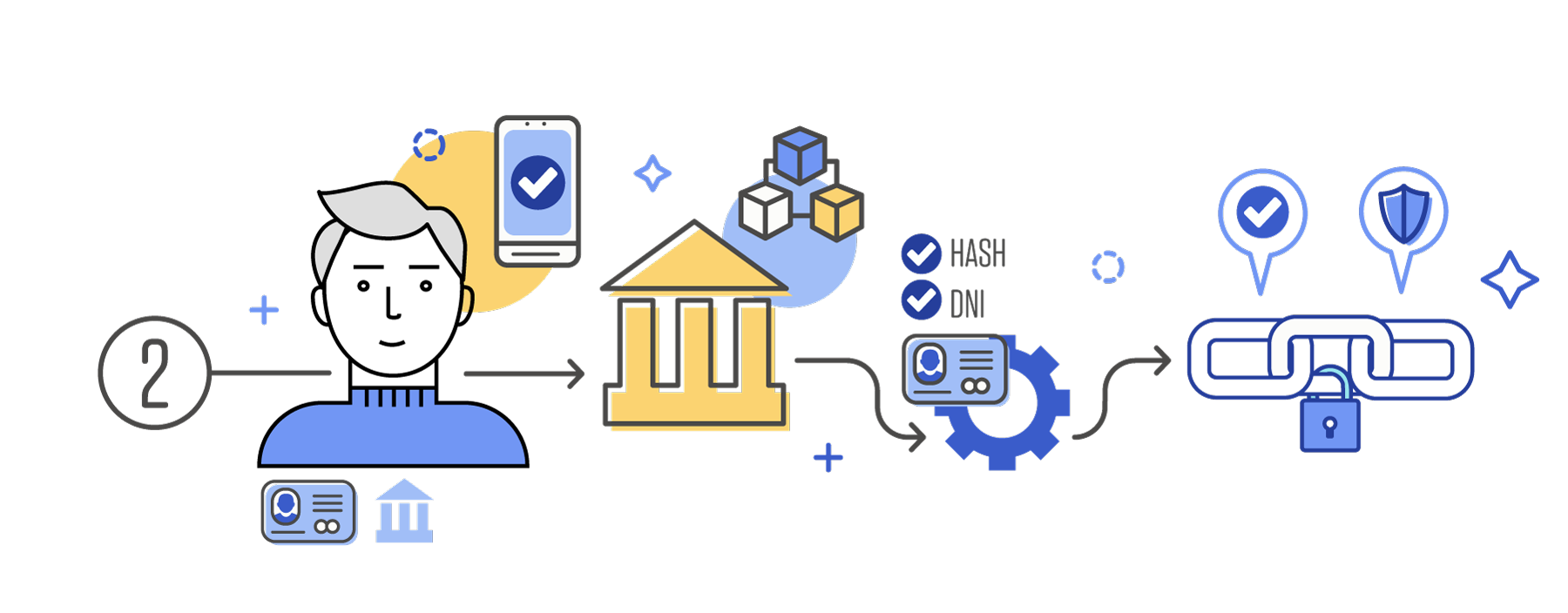

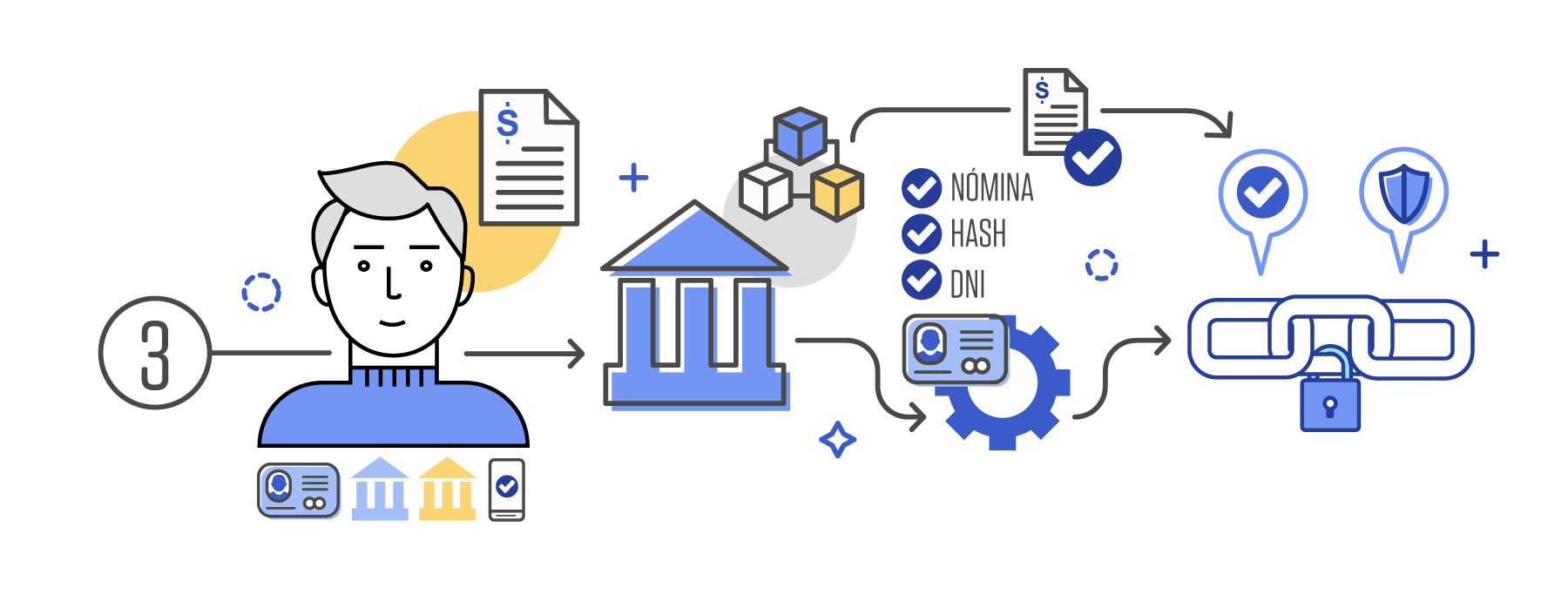

When applying for products at a bank, the user will not have to provide any documentation if they have previously been a customer at one of the associated banks and give their consent to the sharing of their information quickly and securely.

More info

A group of companies of the consortium, together with other collaborators, is currently developing a project using blockchain technology in order to quickly and securely share a customer's identity when registering with a bank.

The aim of the project is to resolve a common problem among all financial institutions, who must verify the identity of a customer when banking with them for the first time. It will achieve this using a platform to enable the banks to efficiently share their identity, always pursuant to the express consent of the customer.

The development of this platform seeks to increase the efficiency of new customer registration processes by sharing documents between companies that belong to the interbank consortium NIURON.

Verifying the digital identity of new customers is a common requirement among the entire sector, and the legal demands regarding this duty to know are becoming increasingly greater, with the rising costs associated with duplicate processes as well as a lower customer retention ratio during the process once the registration process has been initiated.

Therefore, much of the information that is available can be shared without affecting the competitive edge between companies and without having to resort to a trusted third party, since blockchain technology guarantees a neutral and democratic system of governance.

This platform enables the customer to take control of their data, thus, improving their user experience.